The Disability Income Gap

- -

By Wes Caldwell

Most physicians and surgeons carry some amount of disability insurance; however, the majority are very underinsured. Given their earning potential and the fact that the ability to practice is a doctor’s most valuable asset, the maximum amount available should be purchased. Without proper planning, a career-ending disability is the most financially devastating event that can happen to a family.

How much coverage is available?

A common misconception among the medical community is that the disability policies that were available in the 1980s and 1990s can no longer be purchased. Many individuals are under the impression that the occupation definition and policy limits have been restricted. Nothing could be further from the truth. In fact, over the last 10 years, the specialty-occupation definition has improved and the policy limits have increased substantially.

What is the disability income gap?

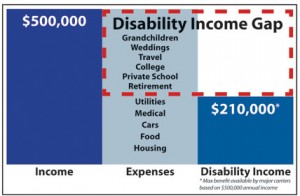

Assuming a doctor buys the maximum amount of coverage available, a total disability will still result in a substantial loss of income. On average, the income loss is about 50%, and as income increases so does the loss. In addition to the income loss, expenses will increase due to medical needs. The gap between pre-disability earnings and the disability-insurance payment will necessitate significant lifestyle adjustments. Retirement-plan contributions, college funding, and discretionary spending will be severely impacted.

Below is a chart to illustrate the Disability Income Gap.

What is the solution?

Solution 1: Supplemental Excess Policy

This policy pays in addition to the monthly benefit received from a traditional disability income policy. It increases the monthly benefit to 70% of pre-disability earnings.

Solution 2: Excess Lump Sum Policy

This policy pays a lump-sum amount in addition to all existing policies. The maximum amount available is generally 5 times earnings up to $2 million of benefit and can cover a doctor through age 64. The lump sum is paid after one year of total and permanent disability. In addition to a reduced ability to save for retirement, a lump-sum disability policy could significantly enhance a doctor’s lifestyle in later years.

Conclusion

Many doctors think they have the maximum amount of disability coverage they can get. Even if they do, a total disability can cause a significant disability income gap. An excess disability policy can help close the gap and prevent severe financial hardship for the doctor and family.

Wes Caldwell heads up Danna-Gracey’s Physician and Employee Benefits Division. He is a 27-year veteran of the financial-services industry and brings a wealth of knowledge to serve the medical community. Wes@dannagracey.com / 800-966-2120