Are you covered for flooding?

Residential Flood Insurance

Every state and 98% of the nation’s counties have experienced a flooding event. Still, only 5% of U.S. residents have flood insurance and only 40% of the A or V zones (FEMA designated as high-risk) are insured. Why aren’t more people buying flood protection? Mainly because homeowners believe one of these myths:

Myth #1: My house isn’t in a “flood zone” or my lender doesn’t require it.

Truth: If in a high-risk (mandatory) flood zone (starts with A or V) then you’re required by law to have flood insurance if you have a mortgage. About 70% of Hurricane Harvey victims did not have flood insurance, mainly because their flooded homes were not in A or V zones, so they were not required to buy it. With 75% of FEMA maps outdated (some as old as 1983), this just isn’t a reliable indicator of risk. 25% of all flood claims occur outside of high-risk (A & V zone) areas.

Myth #2: I have a homeowners policy, so I am covered.

Truth: Homeowners and renters policies do not cover flooding. Customers need a separate flood policy to cover flooding events.

Myth #3: If a flood ever happens, FEMA will bail me out.

Truth: A federal disaster must be declared before FEMA assistance becomes available. If a declaration is made (occurs less than 50% of the time), the “bailout” is usually in the form of a low-interest disaster loan, which must be repaid. Some families also rely on grants which, if provided, are not enough to cover losses. For example, Hurricane Harvey victims received an average grant payout of only $4,300 from FEMA, while the average loss was $116,823.

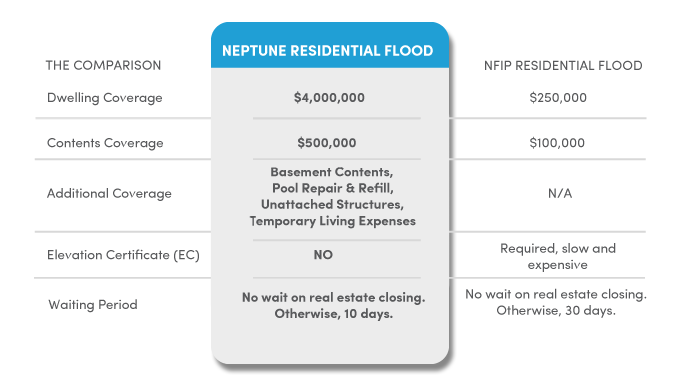

We offer residential Dwelling coverage up to $4,000,000 and Content coverage up to $500,000 with an option to add additional coverages to protect your assets not covered in the National Flood Insurance Program:

Basement Contents (up to $10,000)

NFIP only covers limited basement contents, such as wall fixtures, elevators, air conditioners, and washer/dryer.

Pool Repair and Refill (up to $10,000)

The NFIP specifically excludes coverage for swimming pools. With this endorsement, Neptune will cover swimming pool repair & refill costs.

Unattached Structures on Property (up to $50,000)Neptune will pay up to the limit purchased for ALL Unattached Structures combined. This limit is in addition to Coverage A.

Temporary Living Expenses (up to $10,000)

If your client is unable to live in their home, Neptune will reimburse up to $100 each day for temporary housing and up to $35 a day for each family member residing in the home for food during this time for up to 3 months.

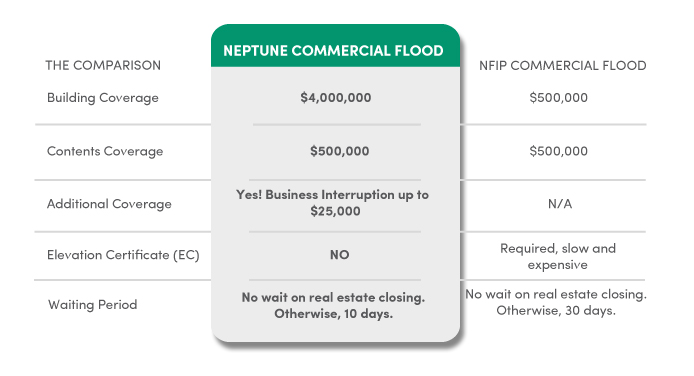

Commercial Flood

Building Coverage is available up to $4,000,000 and Contents Coverage up to $500,000 with an option to add $25,000 in Business Interruption insurance that provides $500 a day for up to 50 days after a 14-day wait period. So, if your building is closed for 64 days after a flooding event, you would collect $25,000 in Business Interruption Coverage. Additionally, unlike an NFIP policy, our program policy covers tenant improvement and betterments with no sublimit.